On May 30, 2020, NASA and SpaceX partnered to send American astronauts from US soil to the International Space Station for the first time since 2011. As a new era spaceflight begins, government entities like NASA and private enterprises like SpaceX will work to innovate their rockets and push boundaries for human space flight. Lubricant manufacturers are tasked with the same challenges to create lubricants that will aid in the journey to reach our ambitious goals.

What are Aerospace Lubricants?

Lubricants in used in aerospace applications such as, space travel, commercial airlines, and defense, are like other lubricants, but face more stringent performance demands. In order to be classified as an aerospace lubricant, products must pass tests that are created by the Department of Defense (DoD) known as “MILSPECS.” To ensure safety and performance for aerospace applications, the MILSPECS create standardization to meet DoD objectives. These MILSPECS test different performance factors such as: corrosion protection, shear stability, compatibility, and water sensitivity.

What Differentiates Aerospace Lubricants?

In addition to meeting various MILSPECS, aerospace lubricants are engineered specifically for aircraft engines and fuel systems. The key difference between aerospace lubricants and non-aerospace lubricants is weight. In space operations, weight is crucial because more fuel is needed, which can become costly. It could also put a strain on how many other supplies could be included in the launch. As the safety of astronauts and functionality of equipment is vital, these lubricants cannot fail.

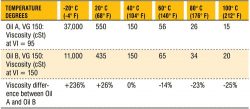

In space applications, lubricants face the most demanding tests. With temperatures in space at near Absolute-Zero and reentry temperatures reaching 5000 F, lubricants must perform in a wider-range of temperatures than their Earth-bound equivalents. Additionally, lubricants must be able to operate in a vacuum environment. This is on top of all of the crucial navigational and life-supporting machines that make space travel possibly. These machines cannot suffer any breakdowns or down time as they support life and other functions both in space and on Earth. Aerospace lubricants must have a long life to maintain these critical operations.

In defense operations, completing the objective is key and your lubricant must perform to ensure the objective is met. These lubricants have to: withstand extreme-temperature jet engines, cargo aircraft landing gears, precise navigational tools, and other wide-temperature components. By selecting lubricants that meet the right MILSPECS you can ensure proper performance and success in your aerospace operations.

Aerospace Lubricant Manufacturing

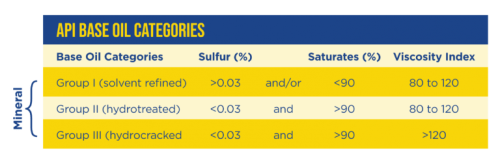

Aerospace lubricants in today’s markets can be in the form of liquids or greases. Most use synthetic base oils to achieve desired results and improve efficiency. Most of these lubricants are made of perfluoropolyether (PFPEs) or Multiply Alkylated Cyclopentane (MACs). Several large manufacturers produce these products that meet various MILSPECS. Twin Specialties has access to a wide variety aerospace and MILSPEC lubricants from Shell and Castrol. Contact us to learn more about our catalog.